Finding the right insurance company is key to protecting your future. You have many choices, but it’s important to think about cost, reliability, and service. The insurance market is big, with many plans for different needs.

Learning about insurance and what to look for in a provider helps. This way, you can pick a company that keeps your interests and assets safe. By looking at trustworthy options, you can find a provider that fits your needs and gives you peace of mind.

Key Takeaways

- Understand the importance of selecting a reliable insurance agency.

- Consider factors such as customer service and affordable premiums.

- Familiarize yourself with different types of coverage available.

- Know that insurance is tailored to meet diverse needs.

- Research leading companies and their ratings to make informed decisions.

Understanding Insurance: What You Need to Know

Insurance is key to protecting you from sudden financial hits. Knowing about different insurance types helps you choose wisely. Each type has its own benefits, fitting different needs.

Types of Insurance Coverage Available

Insurance comes in many forms, including:

- Auto Insurance

- Home Insurance

- Life Insurance

- Health Insurance

Auto insurance covers damage to others and your car. Home insurance protects your property and you from lawsuits. Knowing these can help you pick the right coverage.

How Insurance Works

Insurance pools risks together. This way, many people share the cost of unexpected events. Each policy has important parts, like:

| Component | Description |

|---|---|

| Declaration Page | Includes details like insured parties, covered risks, policy limits, and period. |

| Insuring Agreement | Outlines what is covered; can be named-perils or all-risk. |

| Exclusions | Specifies what is not covered, such as flood or earthquake damages. |

| Conditions | Defines requirements that must be met for coverage to apply. |

Key Terms to Remember

Learning insurance terms is crucial. Key terms include:

- Premiums – The amount paid for insurance coverage.

- Deductibles – The amount you must pay before coverage kicks in.

- Coverage Limits – The maximum amount an insurer will pay for a covered loss.

Understanding these terms helps you make better choices. It ensures you’re well-protected under your policy.

Factors to Consider When Choosing an Insurance Company

Choosing a good insurance company needs careful thought. Look at their reputation and credibility first. Reading customer reviews and checking industry ratings can help you decide.

Good customer service is key. It makes a big difference, especially when you’re filing a claim. Also, make sure they offer the right coverage for you.

Reputation and Credibility

A well-known insurance company has a strong reputation. For example, Westfield has been around since 1848 and has an “A” rating from AM Best since 1934. This shows they are financially strong.

Looking at consumer complaints can give you insight. Talking to friends and family can also help you understand a company’s reputation.

Customer Service Quality

Customer service is very important. Companies like Westfield focus on good customer service. They offer 24-hour claims reporting and a dedicated team during business hours.

They even use texting for claims, making things easier. With over 91 percent of customers happy with claims handling, they show they care about quality service. It’s important to choose a company that communicates well and teaches you about your policy.

Coverage Options

Having the right coverage is crucial. A good insurance company offers many policies to fit different needs. For example, West Bend offers discounts for certain home features.

Don’t just look at prices. It’s important to understand what you’re getting. This way, you can find a policy that’s both secure and valuable.

Comparing Top Insurance Companies

Choosing the right insurance provider is key. Top names like State Farm, GEICO, and Travelers are leaders. They offer great services and make customers happy. Knowing what they provide can help you pick the best for you.

Leading Brands in the Industry

Some insurers really stand out:

- Travelers: NerdWallet gives it a 5.0, making it the top choice in California.

- Geico: With a 4.5 from NerdWallet, it’s the go-to for affordable car insurance.

- Mapfre: Also a 4.5 from NerdWallet, it’s known for fewer complaints than others.

- State Farm: It gets a 5.0 for being easy to use.

Rating Agencies and Their Influence

Rating agencies like A.M. Best and J.D. Power are crucial. They check if insurers are financially strong and customer-friendly. Their scores help people choose the best insurance.

What Customers Are Saying

Customer reviews give real insights into insurance companies. People talk about their experiences with claims, policies, and support. For example, GEICO has the cheapest full coverage, but Travelers is known for quality service.

The Importance of Customer Reviews

Customer reviews are key when picking an insurance company. They show if a company keeps its promises and meets your needs. Good reviews give insights into what a company offers and how it handles claims.

How to Find Reliable Reviews

Finding trustworthy reviews can be tough. Look for sites that offer a variety of feedback. This way, you get a full picture. Watch for patterns in reviews. Many positive ones mean a company is reliable, while lots of negatives might show bigger problems.

Be careful of reviews filled with anger. These might not tell the whole story. Balance them with positive comments to get a fair view.

Reviewing Claims Experience

How a company handles claims is very important. Reviews about this can show if a company is good at fixing problems. If many people say they’re happy with claims handling, it’s a good sign.

Look for common complaints about claims. These can point out areas where a company might need to improve.

Taking Customer Feedback Seriously

Listening to what customers say is important. Companies that care about feedback are more likely to improve. See how a company responds to bad reviews. This shows if they really care about making things right.

Considering feedback along with other things will help you make a smart choice.

| Aspect | Consideration | Importance |

|---|---|---|

| Customer Feedback | Online reviews, reactions, and overall sentiment. | Understanding strengths and weaknesses of insurers. |

| Reliable Reviews | Trustworthy sources, consistency in ratings. | Identifying valuable insights that inform choices. |

| Claims Experience | Handling of claims and resolution times. | Directly influences customer satisfaction and trust. |

The Role of Financial Stability in Your Choice

Choosing an insurance provider means looking at their financial health. This is key for long-term reliability and security. Credit agencies give ratings that show if an insurer can pay claims. Knowing these ratings helps you make a smart choice.

Evaluating Financial Health

Checking financial stability means looking at ratings from A.M. Best, Fitch, Moody’s, and Standard & Poor’s. These ratings show how well an insurer is doing financially. Insurers with high ratings are more reliable, giving you peace of mind.

Understanding Ratings from Agencies

Insurance ratings show how likely an insurer is to default. Ratings like AAA, AA, and A mean they’re very stable. But ratings like BB and B mean there’s more risk. Looking at ratings from different agencies gives a clearer picture.

Importance of Ratings in Selecting an Insurer

Picking a well-rated insurance provider is crucial for getting claims paid on time. Companies with strong ratings do better in tough times. In a market where some insurers take risks, a solid financial background is key.

| Rating Agency | Rating Scale | Investment-Grade Ratings | Non-Investment Grade Ratings |

|---|---|---|---|

| A.M. Best | A++ to D | A++, A+, A | B++, B, B-, C, C-, D |

| Fitch | AAA to D | AAA, AA+, AA | BB+, BB, BB-, B, B-, C |

| Moody’s | Aaa to C | Aa1, Aa2, Aa3 | B1, B2, B3, Caa |

| Standard & Poor’s | AAA to D | AAA, AA+, AA | BB+, BB, B |

Discounts and Savings Opportunities

Looking for affordable insurance services? Exploring discounts can save you a lot on premiums. Many providers offer discounts to lower costs and improve coverage. Knowing these options can greatly reduce your expenses.

Common Discounts Offered

Insurance companies offer several discounts to cut down premiums:

- Bundling Discounts: Save 18% by combining auto and homeowners insurance.

- Multi-Car Discounts: Get 10% to 25% off by insuring multiple vehicles under one policy.

- Driver Safety Discounts: Save 10% to 20% for safe driving habits.

- Good Student Discounts: Qualify for 5% to 25% off based on grades.

- Defensive Driving Discounts: Get 10% to 15% off for completing a defensive driving course.

- Telematics Discounts: Save up to 40% with usage-based programs.

- Low-Mileage Discounts: Enjoy up to 20% off for driving less than 7,500 miles a year.

How to Maximize Your Savings

To get the most from discounts, follow these tips:

- Check your policy often to find all discounts.

- Ask about extra discounts for your job or groups.

- Take defensive driving courses for more savings.

- Bundle policies for better coverage at a lower price.

Importance of Annual Reviews

Annual policy reviews are crucial. They keep you updated on new discounts and coverage changes. Regular checks ensure you’re not overpaying and getting the most savings.

| Discount Type | Typical Savings |

|---|---|

| Bundling Discounts | 18% |

| Multi-Car Discounts | 10%-25% |

| Safe Driving Discounts | 10%-20% |

| Good Student Discounts | 5%-25% |

| Defensive Driving Course Discounts | 10%-15% |

| Telematics Discounts | Up to 40% |

| Low-Mileage Discounts | Up to 20% |

Specialized Coverage Needs

Your insurance needs might go beyond what standard policies offer. This is especially true for high-value assets, where basic policies might not be enough. Specialized insurance can cover various situations, making sure your valuable items or unique risks are well-protected.

Insurance for High-Value Assets

Items like luxury cars, fine art, and collectibles need more than basic homeowner’s insurance. Specialized coverage can protect these assets from risks that regular insurance might miss. Insurers can create custom policies for these high-value items, considering their specific value and situation.

Coverage for Unique Situations

Some situations require special insurance options, especially for businesses in niche markets. This includes product liability insurance for makers and sellers, covering claims from faulty products. Companies like Church Mutual Insurance Company offer tailored coverage for unique needs, understanding the risks in different sectors like nonprofits or schools.

Customizing Your Policy

Customizing your insurance lets you focus on your specific needs, ensuring full protection. Tailoring your policy means adjusting limits, deductibles, and the claims process to fit your needs. For example, comprehensive property insurance can give peace of mind to organizations, letting them focus on their main goals without financial worries.

| Type of Coverage | Average Monthly Cost | Typical Usage |

|---|---|---|

| Product Liability Insurance | Varies | Manufacturers and retailers for product defects |

| Cyber Liability Insurance | $135-$155 | Businesses facing cyber risks |

| Workers’ Compensation Insurance | $35-$55 | Businesses for employee injury protection |

| Medical Malpractice Insurance | Varies | Healthcare professionals for negligence claims |

| Contractor Tools and Equipment Coverage | $10-$25 | Contractors for specialized tools |

By seeking specialized coverage, you can make sure your high-value assets and unique situations get the right attention and protection. Customizing your policy to meet your specific needs offers comprehensive safety and peace of mind. This lets you handle potential risks with confidence.

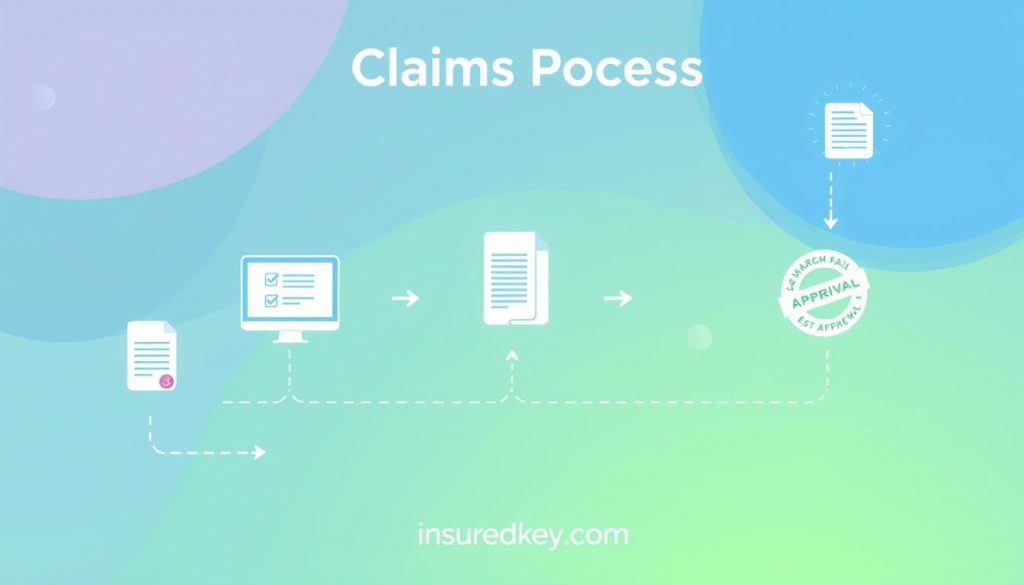

Navigating the Claims Process

Understanding the claims process is key to a successful claim. Knowing how to submit a claim can make a big difference. Start by telling your insurer about any incidents that need a claim right away.

Steps to Submitting a Claim

First, contact your insurance company quickly. Waiting too long can cause problems, like losing benefits or having your claim denied. Gather all important documents, like photos and damage records, before you call.

Common Mistakes to Avoid

When you file a claim, avoid mistakes that could hurt your case. Not giving the right info can cause delays or even denial. Insurance companies might try to find reasons to say no, so make sure you give them all the facts and any laws that apply.

Tips for a Successful Claim Experience

To increase your chances of a successful claim, keep good records. Talk clearly with your insurer and know when to file claims. Sending letters that set payment deadlines can help avoid court. Working with insurance lawyers can also help you get a fair deal. Use smart strategies to get your claim paid quickly.

Utilizing Technology in Insurance

Technology has changed how we handle insurance policies and claims. Digital tools like online portals and mobile apps give us quick access to our policy info. This makes managing insurance easier and more convenient for everyone.

Digital Tools for Easier Management

Now, 61 percent of insurance customers want to check their application status online. Insurers are spending big on IT to meet this demand. In 2019, they spent almost $225 billion on it. This shows they’re serious about keeping up with technology, but old systems can slow them down.

Mobile Apps and Online Portals

Mobile apps are key for many insurance users. For example, State Farm’s Pocket Agent app makes filing claims easy without paper. Companies like Fukoku Mutual Life Insurance see big savings with AI and expect to save a lot in their first year. This shows the financial benefits of using technology.

The Future of Insurance Technology

The future of insurance tech looks bright. AI, IoT, and blockchain will change the industry a lot. Insurers are moving to cloud-based systems to be more flexible and meet customer needs. Even though we’re just starting, the potential for better efficiency and customer happiness is huge.

The Impact of Local vs. National Providers

Choosing between a local insurance company and a national provider can greatly affect your experience. Each option has its own benefits and drawbacks. Knowing these can help you decide what’s best for you.

Pros and Cons of Local Insurance Companies

Local insurance companies often provide personalized service. They have strong ties to the community and offer coverage tailored to local risks. Local agents can give insights into specific insurance needs in your area.

- Benefits:

- Personalized customer service

- Knowledge of local regulations and risks

- Community-focused policies

- Drawbacks:

- Limited coverage options compared to larger providers

- Potentially less competitive pricing

- Less robust technology and resources

Benefits of Choosing National Providers

National providers offer a wide range of coverage options at competitive prices. They have advanced technology, making it easy to manage policies online or through mobile apps.

- Advantages:

- Extensive coverage options, including specialty insurances

- Competitive pricing due to larger market share

- Advanced technology and nationwide network for claims

- Disadvantages:

- Less personalized service due to scale

- Potential for bureaucracy

- Service quality may vary by location

Hybrid Approaches to Insurance Coverage

A hybrid insurance approach combines the best of both worlds. You might find a local agent who represents a national provider. This way, you get diverse coverage options and personalized service. It’s a great option for those who want to meet unique needs without breaking the bank.

Think about your needs and preferences when choosing insurance. You might prefer a local company, a national provider, or a hybrid approach. The right choice depends on what you value most.

Making the Final Decision

As you near the end of your insurance search, it’s key to narrow down your choices. Focus on insurers that meet your specific needs. Look for providers known for good customer service and the right coverage.

This shortlist will be your guide for the final choice. It’s important to pick wisely.

Creating a Shortlist of Candidates

Once you’ve narrowed down your options, prepare questions for insurers. Ask about coverage, costs, and any exclusions. Knowing these details helps you make a better choice.

Also, check out reviews and ratings from others. This way, you can compare your options well.

Questions to Ask Potential Insurers

Trust your instincts when choosing an insurer. Your feelings about their service matter a lot. If you’re unsure, it’s okay to look elsewhere.

Your comfort with their service is crucial. It ensures you make a choice that’s right for you.

FAQ

What is the best insurance company for my needs?

The best insurance company for you depends on your specific needs, budget, and preferences. Look at top-rated insurance companies. Consider affordability, reliability, and customer service.

How can I determine if an insurance provider is reliable?

Check customer reviews and industry ratings from A.M. Best and J.D. Power. Also, look at their claims processing and customer service history.

What types of insurance coverage should I consider?

Think about auto, home, life, and health insurance. Choose the best coverage for your unique needs.

How can customer reviews help me choose an insurance company?

Customer reviews give insights into other policyholders’ experiences. They highlight strengths and weaknesses. Claims experiences are especially important for reliability.

What financial factors should I consider when choosing an insurer?

Check the insurance provider’s financial stability with A.M. Best ratings. A strong rating means they can handle claims over time.

Are there discounts available for insurance policies?

Yes, many providers offer discounts. Look for bundling, safe driving, and other incentives. Always ask about discounts.

How do I navigate the claims process?

Know the steps to submit a claim and document all information clearly. Avoid mistakes like missing deadlines and provide accurate info.

What are the advantages of using technology in managing my insurance?

Digital tools, mobile apps, and online portals make policy management easier. They help with filing claims and improve your experience with trusted companies.

Should I choose a local or national insurance provider?

It depends on what you prefer. Local providers offer personalized service, while national ones have broader coverage and tech resources. Think about what matters most to you.

How can I make a final decision about choosing an insurance company?

Narrow down your options and prepare questions for potential insurers. Ask about policies, pricing, and coverage. Trust your instincts to choose a reliable agency that fits your needs.